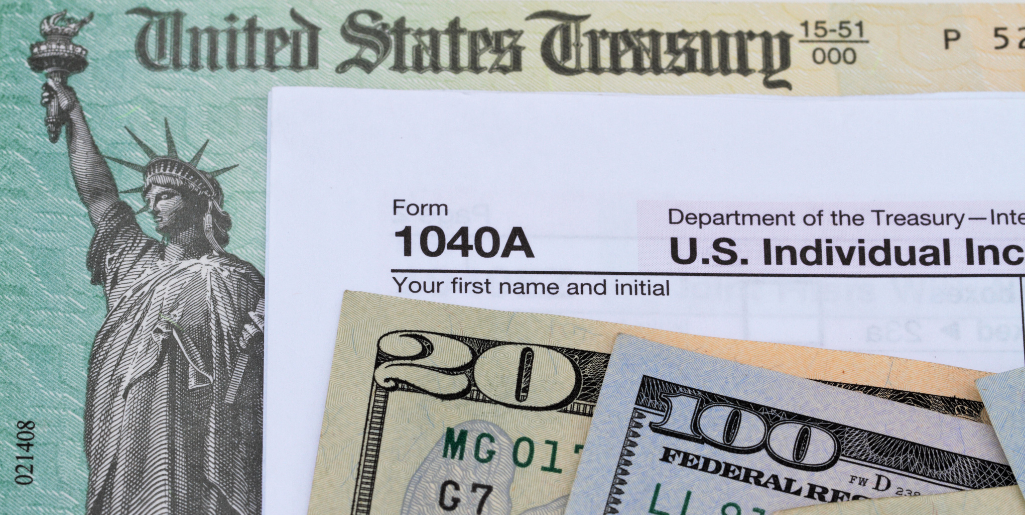

Do undocumented immigrants pay taxes?

Undocumented immigrants play a crucial role in the U.S. economy, not only through their labor but also through substantial tax contributions that support public services and government programs.

- In 2023, households led by undocumented immigrants paid $89.8B in total taxes. This includes $33.9B in state and local taxes and $55.8B in federal taxes.

- In 2023, approximately 4.9% of the U.S. workforce was undocumented.

- 89.4% of undocumented immigrants are of working age.

Our Map the Impact tool shows the tax contributions of immigrants at the national, state and local level.

Recent Features

- Blog

Tax Day is approaching, but the Trump administration’s mass deportation efforts may make many undocumented immigrants hesitant to file taxes. Some worry that providing personal information to the Internal Revenue Service (IRS) could be used against them.